Opportunity Tax Credit

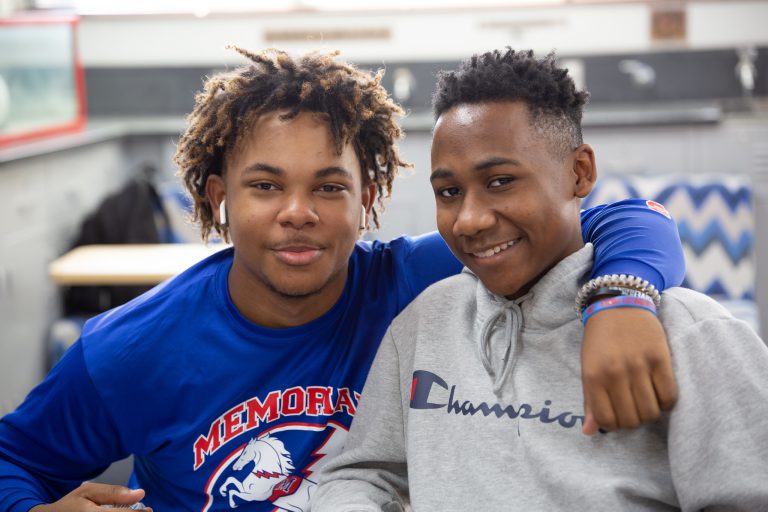

Make a meaning impact in the lives of our students!

Take advantage of this opportunity to give back to Tulsa Public Schools and save on your tax bill!

The Oklahoma Equal Opportunity Education Scholarship Act empowers you to choose our students as beneficiaries of a portion of the taxes that you pay.

Our partnership with Go for Public Schools allows you to choose Tulsa Public Schools as the beneficiary of a contribution that allows you to receive a tax credit!

Your contribution powers innovative education initiatives that benefit ALL students in Tulsa Public Schools.

“We are excited for this opportunity to support Tulsa Public Schools and public school districts throughout the state. We know that a healthy and strong public school district is paramount to have a thriving community. We hope that individuals and companies of all sizes take advantage of the Oklahoma Equal Opportunity Education Scholarship Act and support the school districts near them. We know that together we can build a stronger community through the support of public education.”

– Moises Echeverria, President & CEO of the Foundation for Tulsa Schools

The Foundation for Tulsa Schools has partnered with GO for Public Schools to make this process seamless for contributors.

One-year contributions may receive up to 50% in tax credits and two-year contributions may receive up to 75% in tax credits. The sample amounts below are calculated to receive the maximum state tax credit.

1-Year Commitment | ||

Annual Amount | 50% Tax Credit | |

Filing as an individual | $2,000 | $1,000 |

Couple Filing Jointly | $4,000 | $2,000 |

Business Entity | $200,000 | $100,000 |

2-Year Commitment | |||

Pledge | Annual Amount | 75% Tax Credit | |

Filing as an individual | $2,667 | $1,333 | $1,000 |

Couple Filing Jointly | $5,334 | $2,667 | $2,000 |

Business Entity | $266,000 | $133,000 | $100,000 |

Frequently Asked Questions

Tax credits and tax deductions both decrease the total that you’ll pay in taxes, but they do so in different ways. A tax credit is a dollar-for-dollar reduction of the money you owe, while a tax deduction will decrease your taxable income, leading to a slightly lower tax bill.

| A Tax Deduction | A Tax Credit |

| REDUCES TAXABLE INCOME | REDUCES INCOME TAXES |

| A $1,000 tax deduction in a 35% tax bracket saves you $350 in taxes | A $1,000 tax credit in ANY tax bracket saves you $1,000 in taxes |

Any individual, family or qualified business entity paying taxes in Oklahoma is eligible to contribute to their foundation designated fund and receive tax credits.

- All individual taxpayers making a single-year contribution are eligible for Oklahoma income tax credits up to 50% of the allowable contribution amount. The amount of tax credits may not exceed $1,000 for individual filers, $2,000 for those filing jointly. Contributors who pledge in writing to give the same amount over TWO consecutive years may receive up to a 75% tax credit for BOTH years.

- All qualified businesses are eligible for Oklahoma income tax credits up to 50% of the allowable contribution amount. The amount of tax credits may not exceed $100,000. Contributors who pledge in writing to give the same amount over TWO consecutive years may receive up to a 75% tax credit for BOTH years.

Yes! All taxpayers can make a contribution if filling takes individually or jointly both for their personal taxes and for their qualified business.

Your tax credits may be used in the immediate following year. For example, tax credits received from a 2022 contribution may be used to offset income taxes on your 2022 Oklahoma tax return filed in 2023.

The tax credit is good up to the state tax liability. The tax credit from a public school district or school foundation is not refundable. You may only use this tax credit as an offset to Oklahoma income taxes. Any tax credit not used in a given tax year due to no tax liability may be carried over for up to three years.

Donations that are postmarked by December 31 will count as a charitable contribution made during that calendar tax year.

The tax credit that you get for contributing may be claimed when you file your tax return the following year. Federal and state tax deductions for your charitable contribution may also be claimed, if you itemize, when filing your annual tax returns.

Please consult your professional tax advisor for specific tax advice.

2022 Sponsorship opportunities

Our children are our community’s most critical resource. At the Foundation for Tulsa Schools (FTS), we invite you to partner with us to strengthen Tulsa Public Schools (TPS). TPS is an economic engine for Tulsa. With over 33,000 students, TPS is the largest education provider in the region, producing graduates that go on to be employed by many of Oklahoma’s leading companies. At FTS, we believe that our students have unbelievable potential and that if we invest in them in ways to help them unleash their potential, we can help put them on a path to long-term success. Our hard-working teachers, support staff, and school leaders are doing the best they can in the face of dwindling state support, budgetary challenges, and increased mandated social services. But they cannot do it alone. They need your support to provide a positive impact on our children and Tulsa’s future.

The business and philanthropic community has a tremendous stake in the future of public education in Tulsa. Investing in Tulsa Public Schools has the potential to yield tremendous returns. A well-educated and competitive workforce in Tulsa will provide existing companies with access to talent, help recruit new companies, and make Tulsa a more attractive community to work and raise a family. We hope you will consider renewing your support or becoming a supporter of the Foundation for Tulsa Schools. Together we can help create a brighter tomorrow for our students and our community.

AMAZON SMILE

Amazon donates 0.5% of the price of eligible AmazonSmile purchases to the Foundation for Tulsa Schools. AmazonSmile is the same Amazon you know. Same products, same prices, same service. It couldn’t be easier to support the students and teachers of Tulsa Public Schools.

FOUNDATION FOR TULSA SCHOOLS

3027 South New Haven Avenue

Tulsa, OK 74114

(918) 746-6600